You had plans and dreams centered around attending college at a particular location. To do that, though, you took on loans. No problem, right? After all, people seek financial assistance all of the time to earn their higher-level degrees. Unfortunately, though, life happens, and sometimes it’s hard to meet your commitment while handling the other obstacles life hands you. If you’re facing struggling to pay off that student loan, try one of the following three things.

1. Reevaluate Your Budget

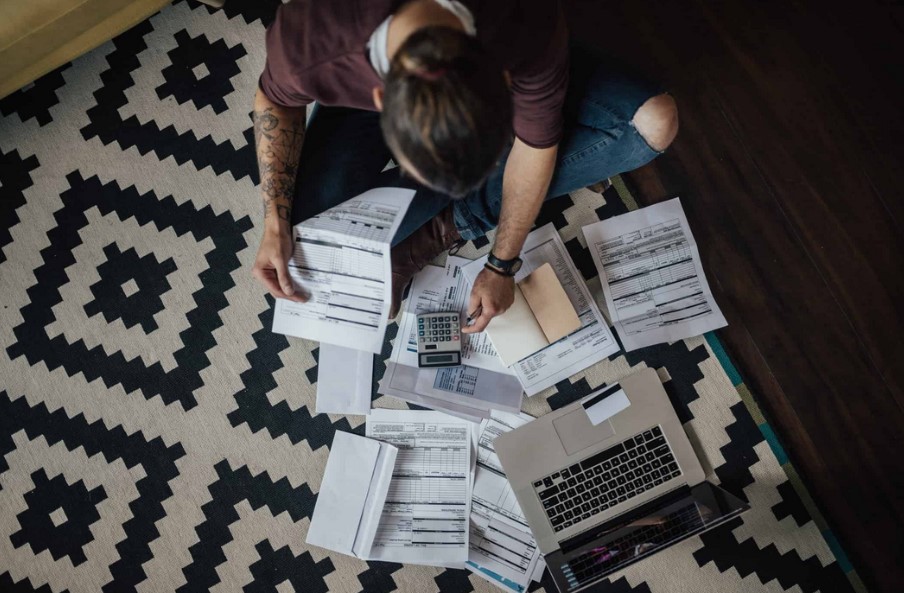

Start by really considering your monthly budget. Are you paying for things that you don’t need? Where could you cut back and be okay? To know these answers, create a spreadsheet of income versus expenses. Assess which areas demand the most financial support. See if you can tweak anything to allocate more money. The following could work as viable options:

- Relocate to pay less in rent

- Decrease your expenses

- Fine-tune your grocery bill

- 2. Speak With a Lawyer

2. Speak With a Legal Team

You may feel lost in this process and uncomfortable facing loan officers on your own. If that is the case, meet with a student loan lawyer Columbia MD to discuss possibilities. Explain your current troubles and why you cannot make the payments. Collaborate to reduce the bills, lower interest or defer the loan.

3. Talk to the Loan Officer

Companies don’t want people to default on loans. It’s not a win for them, so sometimes, the agency is willing to modify the loan for you. Call up the loan officer in charge of your loan. Have a polite and professional conversation about your current circumstances. Ask if something can be done to help you out.

Many people struggle to meet their student loan payments, so know that you aren’t alone. There is help out there. Try working with your budget first. If that doesn’t solve the problem, reach out to experts for assistance.